1 Introduction to FinOps

This chapter introduces the shift from traditional, capital-intensive data centers to flexible cloud platforms and explains how that agility often masks hidden, fast-growing costs. Through stories of a VC-backed AI startup, a global e‑commerce company, and a regulated enterprise running multi‑cloud, it shows how unchecked provisioning, complex pricing, and a lack of governance and visibility lead to runaway spend, budget shocks, and operational sprawl. It also highlights why cloud cost prediction is hard—varying instance types, regions, pricing models, storage, and data transfer—making OpEx more dynamic and less predictable than past CapEx models.

To address these challenges, the chapter introduces FinOps as a cross-functional discipline that aligns engineering, finance, and business to turn cloud spending into business value. FinOps rests on five principles—collaboration, transparency, optimization, accountability, and agility—and replaces reactive, siloed “cost cutting” with proactive, data-driven decisions tied to outcomes like speed, reliability, and customer experience. Compared with traditional cloud cost management, FinOps emphasizes continuous optimization, shared ownership, and real-time insights that balance cost, performance, and time-to-market.

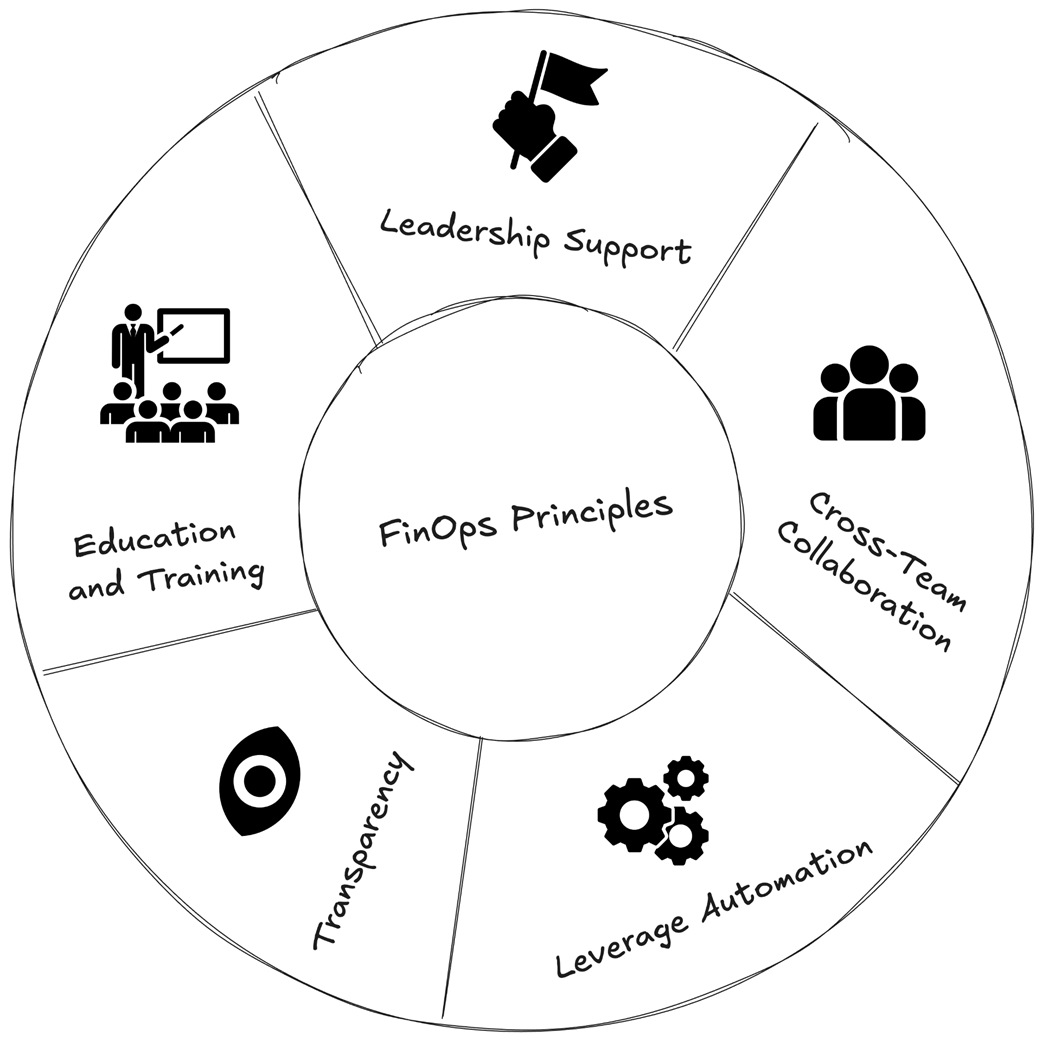

Adopting FinOps is framed as a cultural and operational journey: invest in education, establish tagging and cost allocation, build shared dashboards, automate guardrails and rightsizing, standardize policies, and secure leadership support while fostering cross-team rituals and accountability. The chapter maps common pitfalls—poor visibility, siloed teams, overprovisioning, multi-cloud complexity, lagging monitoring, pricing intricacy, and unclear ownership—to practical remedies and notes cases where a full FinOps program may be unnecessary (e.g., small, predictable spend or short-lived projects). The takeaway: treat FinOps as continuous improvement that scales governance and insight alongside cloud adoption to maximize value and minimize waste.

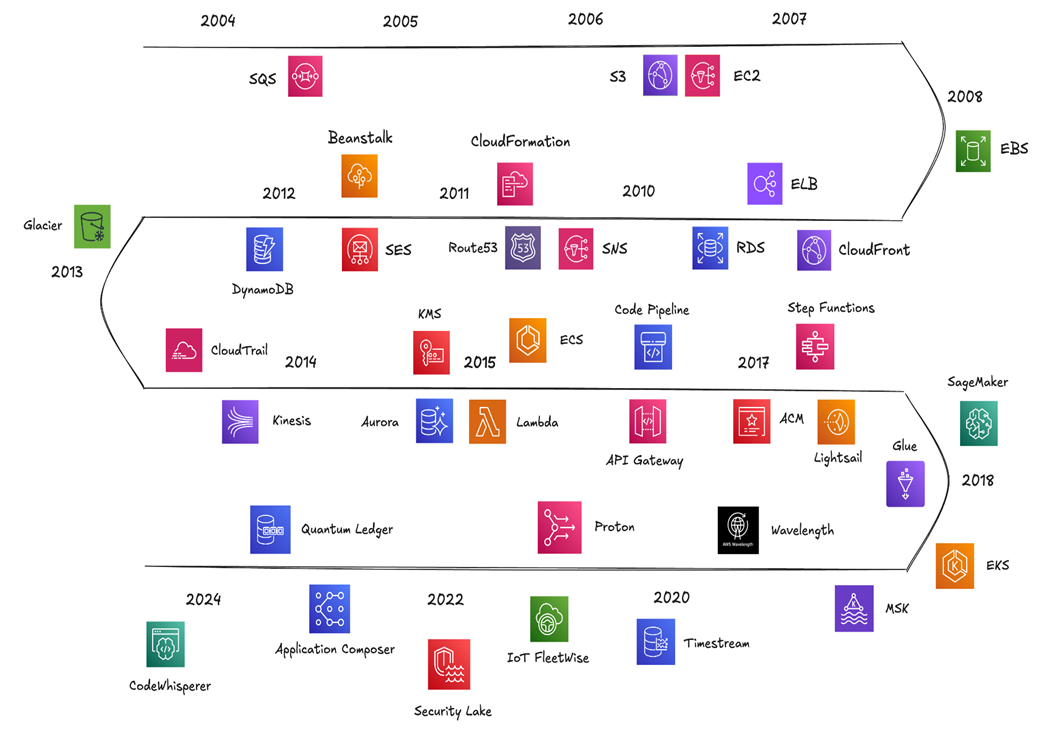

AWS services launch over time

FinOps principles

FinOps principles

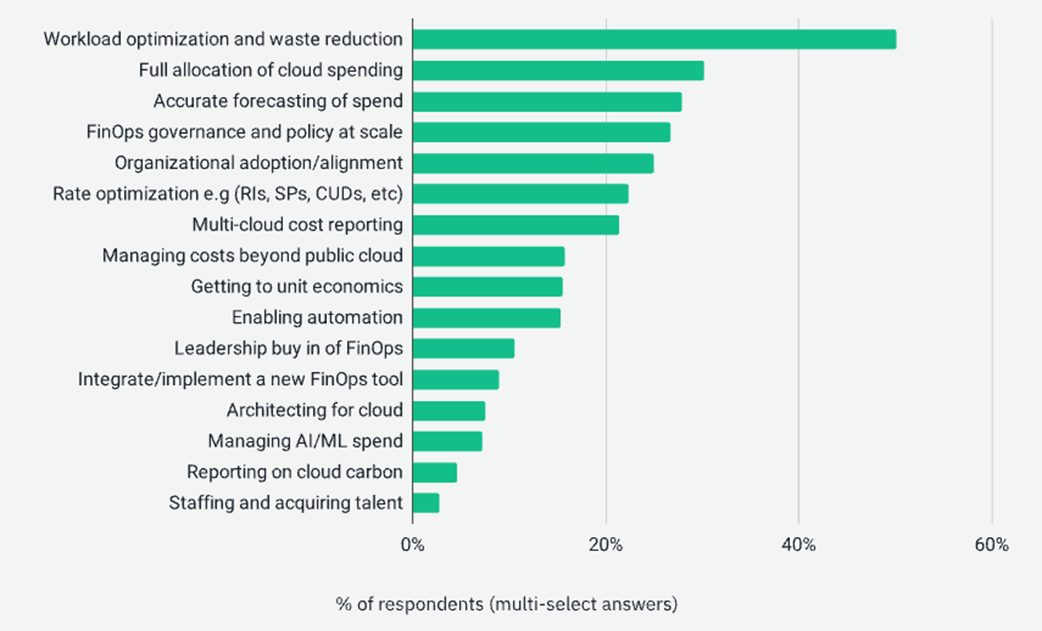

FinOps Challenges according to the State of FinOps 2025 report

Summary

- Cloud computing changed how businesses use technology, moving from owning computers to renting them online.

- This new way of using technology made it harder for companies to predict and control their costs.

- Many businesses found hidden costs in cloud services, often because they didn't understand all the charges or weren't using what they paid for.

- FinOps was created to help businesses manage their cloud money better by getting different teams to work together.

- FinOps focuses on seeing costs clearly, using resources wisely, and ensuring everyone is responsible for their cloud use.

- Unlike old ways of managing costs, FinOps looks at the big picture and tries to use cloud spending to help the business grow.

- To use FinOps, companies need to change how they think about cloud costs and get everyone involved.

- Common problems include not seeing all costs, teams not talking to each other, and not knowing how to use cloud services efficiently.

- To fix these problems, companies can use dedicated tools, get teams to work together, train their staff, and set clear rules for using the cloud.

- FinOps is not a one-time fix but an ongoing learning process that improves how cloud money is spent.

FAQ

What is FinOps and why does it matter?

FinOps (Financial Operations) is a discipline that aligns engineering, finance, and business teams to make smarter, real-time decisions about cloud spending. It goes beyond cost-cutting to ensure cloud investments drive business value through collaboration, transparency, optimization, accountability, and agility.How is FinOps different from traditional cloud cost management?

Traditional cost management is reactive and siloed, focusing mainly on reducing spend when budgets spike. FinOps is proactive and collaborative, using shared metrics and continuous optimization to balance cost, speed, and quality so decisions align with business goals.What are the core principles of FinOps?

- Collaboration: Finance, engineering, and operations share responsibility for costs.- Transparency: Real-time visibility with dashboards, reports, and alerts.

- Optimization: Right-sizing, the right pricing models, and automation.

- Accountability: Clear budgets and owners measured against goals.

- Agility: Rapid, cost-aware scaling up/down as needs change.

What hidden costs often surprise teams in the cloud?

Common drivers include idle or underutilized resources, misconfigured services (e.g., unlimited log retention), data transfer charges, attached storage (EBS/disks), regional price differences, and ancillary services (load balancers, monitoring). Multi-cloud adds complexity with distinct pricing and billing models.Which EC2 pricing options exist and when should I use them?

- On-Demand: No commitment, maximum flexibility, highest cost—great for spiky or unpredictable workloads.- Spot Instances: Deep discounts but can be interrupted—best for fault-tolerant, batch, or stateless jobs.

- Reserved Instances: 1–3 year commitment for lower prices—works for steady-state workloads with predictable usage.

- Savings Plans: Commit to a spend level for flexible savings across instance families—easier to manage than RIs.

Why is multi-cloud cost management hard, and how can we manage it?

Each provider has unique services, pricing, regions, and discounts, making apples-to-apples comparisons difficult. Use a multi-cloud cost platform, standardize tagging and policies, create a Cloud Center of Excellence, and harmonize data (e.g., with FOCUS) to unify visibility and optimize placement.What cultural changes are required to succeed with FinOps?

Leadership sponsorship, cross-team collaboration, shared KPIs, and ongoing education. Make costs visible (open dashboards), set review cadences, reward cost-saving behaviors, and embed cost awareness into daily decisions across engineering and finance.What practical steps improve cost visibility and control early on?

- Establish a consistent tagging strategy (project, owner, environment, cost center).- Build real-time dashboards and budgets with alerts.

- Hold regular “cloud cost reviews.”

- Automate governance (e.g., policies, guardrails) and optimization (rightsizing, autoscaling, scheduled shutdowns).

What are common FinOps adoption challenges and how do we overcome them?

- Lack of visibility: Use native/cloud-agnostic tools, enforce tagging, and review routinely.- Siloed teams: Form a cross-functional FinOps team; align on shared metrics (e.g., cost per transaction).

- Skills gaps: Provide training in cloud economics and create FinOps roles.

- Overprovisioning: Rightsize regularly, use autoscaling/serverless, and lifecycle tags.

- Real-time monitoring gaps: Enable alerts, dashboards, and spend caps.

- Governance issues: Define/enforce policies (e.g., via AWS Config, SCPs, Azure Policy).

- Resistance to change: Start pilots, share wins, and gamify savings.

- Unclear ownership: Tag owners, automate audits, and decommission systematically.

What do the real-world stories in this chapter teach about cloud costs?

- Startups can burn runway quickly with unchecked GPU-heavy workloads.- Scale-ups can accumulate idle/misaligned resources across regions and teams.

- Enterprises face fragmented multi-cloud usage without governance. In all cases, FinOps restores visibility, accountability, and value-focused decision-making.

Practical FinOps ebook for free

Practical FinOps ebook for free