1 Introduction to Bitcoin

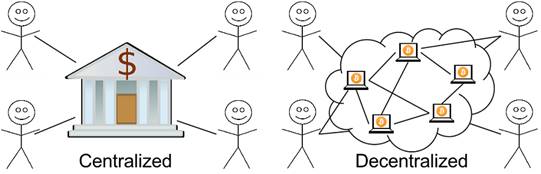

Bitcoin is introduced as a decentralized, permissionless digital cash system that enables people to transfer value directly over the internet without banks or other trusted intermediaries. The network is composed of thousands of equal peers (nodes) that enforce the rules, keep identical copies of a public ledger, and issue new coins on a predictable schedule; no single party controls it. Around this core, an ecosystem of end users, merchants, companies, service providers, exchanges, and open-source developers has formed, and anyone seeking maximum assurance can verify everything independently by running their own node.

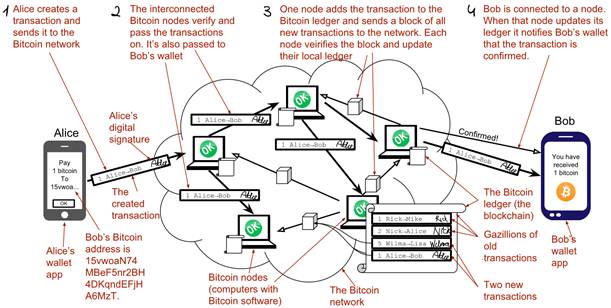

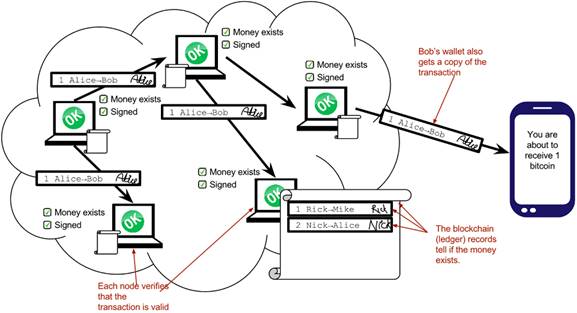

The chapter illustrates payments by following a simple transaction from Alice to Bob. Alice’s wallet builds a transaction specifying the amount and Bob’s address, authorizes it with a digital signature derived from her private key, and broadcasts it. Nodes validate that the funds exist and the signature is correct, then relay it; later, miners group transactions into a block and, after solving a computational challenge, publish it so all nodes append it to the blockchain—an append-only ledger that establishes a common order of events. Wallets connect to nodes to monitor addresses and notify users when funds arrive; they also safeguard the private keys needed to spend, making key management central to using Bitcoin safely.

Motivating Bitcoin, the chapter contrasts it with today’s money: many people lack access to banking, electronic payments can be monitored, censored, frozen, or seized, inflation can erode savings, and cross-border transfers are slow and costly. Bitcoin’s approach—decentralization, a borderless network, and a strictly limited supply—addresses these issues and supports uses such as savings, remittances, online shopping, and non-currency applications like ownership proofs and document timestamping; its price emerges on open markets. It also notes current limitations and risks, including fees and throughput for tiny or instant payments, confirmation delays, volatility, and the user’s responsibility for key security, while pointing to emerging layers like the Lightning Network and observing that although many alternative coins exist, network effects make broad adoption and durability uncertain compared with Bitcoin.

1. The Bitcoin network and its ecosystem.

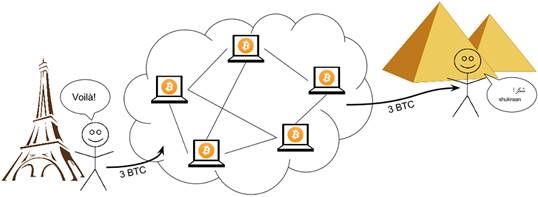

A Bitcoin payment. The payment is processed in 4 steps.

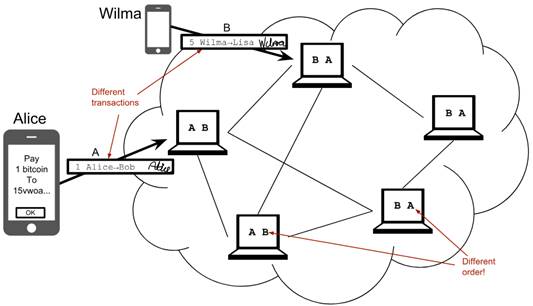

Step 1: Alice creates a transaction, signs it and sends it to one or more Bitcoin nodes in the Bitcoin network.

Alice has sent her transaction to a node in the network. The node will verify the transaction and forward it to other nodes. Eventually the transaction has reached all nodes in the network.

Transactions arrives in different order at different nodes. If they would all write the transactions to the blockchain, the different nodes' blockchains would differ.

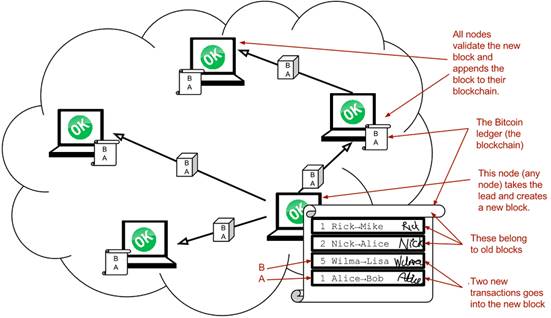

One node takes the lead and tells the others what order to add the transactions in. The other nodes verify the block and update their blockchain copies accordingly.

Bob’s wallet have asked a node to notify the wallet upon activity in his Bitcoin address. Alice pays to Bob’s address, and the node has just written the transaction to the blockchain, so it notifies Bob’s wallet.

8. Inflation

Centralized and decentralized services

The supply of bitcoins over time

Bitcoin is borderless

Price in USD since beginning of Bitcoin

Recap

In this chapter you learned that

- Bitcoin is global, borderless money, that anyone with an internet connection can use.

- Bitcoin is used by many different actors, like savers, merchants, traders for many different purposes like payments, remittances and savings.

- A network of computers, the Bitcoin network, verifies and keeps records of all payments.

- A transaction goes through the steps: Send transaction, verify transaction, add transaction to the blockchain, notify recipient and sender wallet.

- It solves problems with inflation, borders, segregation and privacy by providing limited supply, decentralization and borderlessness.

- There are several alternative cryptocurrencies apart from Bitcoin, for example Ethereum, Zcash and Namecoin.

- A (crypto)currency needs to have enough users and activity to be useful. It’s called network effect.

FAQ

What’s the difference between “Bitcoin” and “bitcoin”?

“Bitcoin” (capital B) refers to the system and network. “bitcoin” (lowercase b) is the currency unit. Common symbols include ฿, BTC, and XBT (this chapter mostly uses BTC).Who runs or controls Bitcoin?

Nobody owns or controls Bitcoin. Thousands of computers (“nodes”) around the world run the software and enforce the rules. The system is decentralized and permissionless: anyone with internet access can use it or even run their own node, and all users are treated equally.Is Bitcoin anonymous?

Bitcoin does not use names, but transactions are public. Activity is tied to addresses/keys rather than personal identities, which is better described as pseudonymous. Good privacy requires care; by default, payments can be analyzed on the public ledger.How does a Bitcoin payment work, end to end?

A typical payment follows four steps:- The sender’s wallet creates a transaction, signs it with a private key, and broadcasts it.

- Nodes verify the transaction (funds exist, signature is valid) and relay it across the network.

- The transaction is included in a block and appended to the blockchain (the global ledger).

- Wallets learn about the update and notify the recipient that funds were received.

What is the blockchain, and why are miners needed?

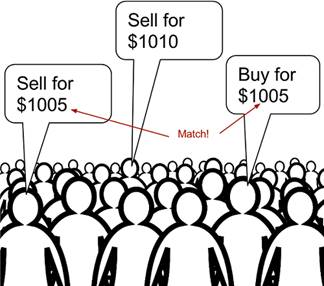

The blockchain is an append‑only, shared ledger of all transactions. Because many transactions arrive concurrently and in different orders at different nodes, blocks are used to agree on ordering. Miners compete to create the next block by solving a hard puzzle; the winner proposes the ordered set of transactions and earns newly minted bitcoins plus fees. This process coordinates the ledger and makes tampering detectable and costly.What is a Bitcoin wallet, and what are private keys?

A wallet is software or hardware that manages your keys and transactions. Its main jobs are to:- Manage private keys (the secrets used to sign and spend funds)

- Monitor incoming/outgoing activity

- Create and send transactions

What problems with today’s money does Bitcoin address?

- Segregation: Many people lack access to bank accounts or online payments; Bitcoin is open to anyone with internet access.

- Privacy and censorship: Traditional systems can trace, censor, freeze, or seize funds; Bitcoin reduces reliance on central intermediaries.

- Inflation: Fiat money supplies can be expanded; Bitcoin’s supply is capped at 21 million (on a predetermined schedule until ~2140).

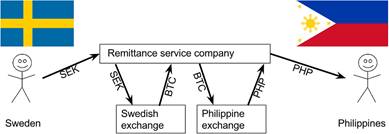

- Borders: Cross‑border transfers in fiat are slow/expensive; Bitcoin is natively global.

How is Bitcoin used in practice?

Common uses include:- Savings: Store value by safeguarding private keys (from paper to hardware wallets).

- Cross‑border payments/remittances: Send globally, often cheaper/faster than legacy rails.

- Shopping: Pay online without sharing sensitive card data.

- Speculation: Trade on price volatility (high risk).

- Non‑currency uses: Record ownership or “proof of existence” by embedding small data (e.g., document hashes) in transactions.

When is Bitcoin not a good fit (or what should I be cautious about)?

- Tiny payments: On‑chain fees relate to data size, not amount, so fees can dominate small payments. Layer‑2 tools like the Lightning Network help.

- Instant finality: Recipients should wait for confirmations (often ~10–60 minutes) to avoid double‑spend risk; Lightning can enable instant small payments.

- Savings you can’t afford to lose: Risks include key loss/theft, price swings, regulatory crackdowns, software bugs, or cryptography weaknesses (unlikely but not impossible). Use appropriate security.

Grokking Bitcoin ebook for free

Grokking Bitcoin ebook for free