1 Exploring FinTech and Generative AI

This chapter introduces FinTech as the application of technology to improve how money is handled, tracing its roots from early tools to today’s digital payments, crowdfunding, gig platforms, and cryptocurrencies. It sets expectations for a full-stack learning journey: readers will work across UI, APIs, databases, and backend services while modernizing a real-world style payment tool for a fictional company, Futuristic Fintech. The project centers on the Automated Clearing House (ACH), a cornerstone of US payments, using it as a concrete context to explore systems design, data flow, and the practical realities of building financial software.

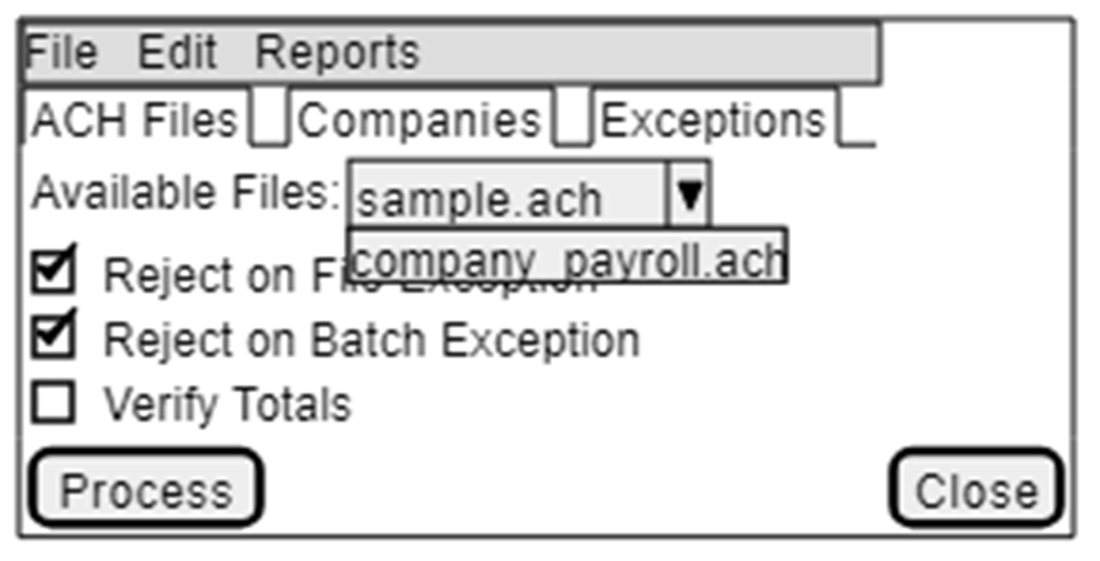

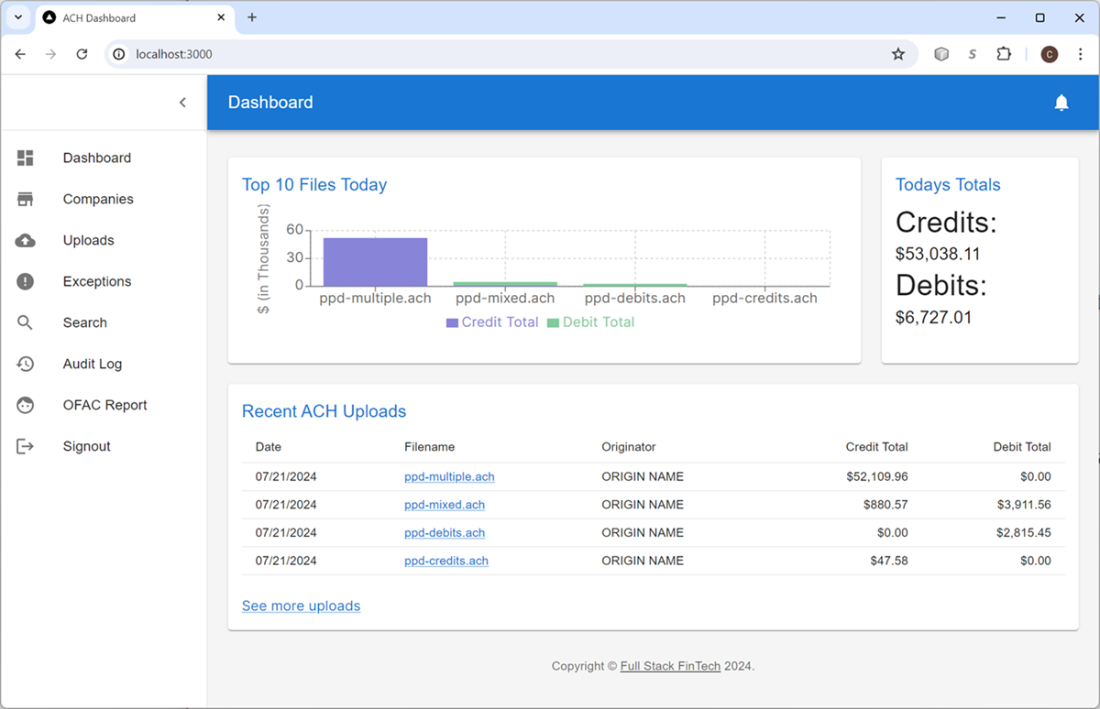

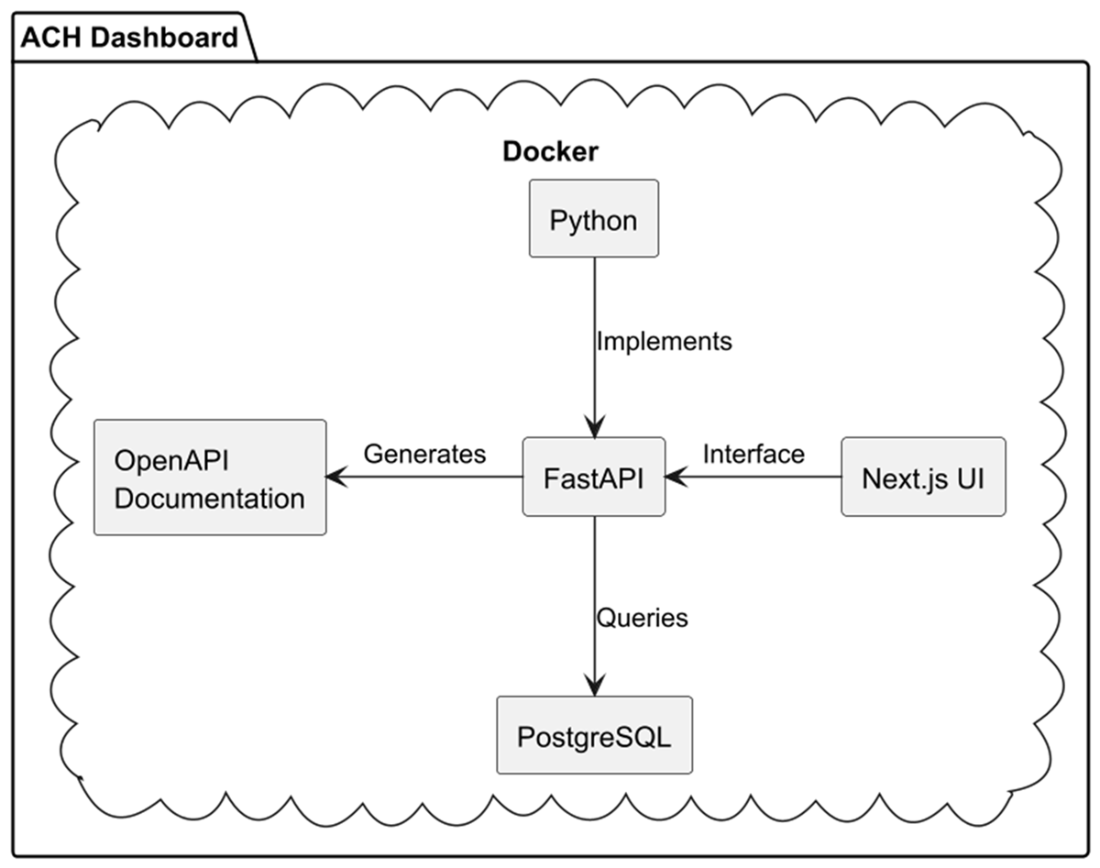

The chapter frames the modernization of an ACH Dashboard as a typical enterprise initiative, explaining why products are refreshed (compliance, cost, design alignment, repositioning) and how such efforts unfold. It outlines ACH’s prominence and interaction with international counterparts, the rise of Same Day ACH, and the broader push toward real-time payments. Work is organized with SAFe Agile concepts like PI Planning, iterations, and epics/stories. Clear problems in the legacy interface (file uploads, reporting, access constraints, and inconsistent styling) motivate a target architecture featuring PostgreSQL for analytics-friendly storage, a Next.js UI with visualizations, Python replacing COBOL services, and Dockerized components, supported by common developer tooling with flexibility to substitute equivalents.

The chapter then offers a pragmatic first look at Generative AI as a “better rubber duck” that can brainstorm, scaffold code, add type hints, debug logic, and accelerate tasks from Python snippets to simple D3 visualizations. It stresses prompt engineering and problem formulation, but equally emphasizes verification and accountability for generated code. Crucial cautions include safeguarding sensitive data (NPI/PII) and proprietary code, respecting ownership and policy constraints, and recognizing model currency and version differences. The takeaway is a balanced approach: Generative AI can materially boost productivity in financial software development when paired with disciplined validation, security awareness, and sound engineering practices.

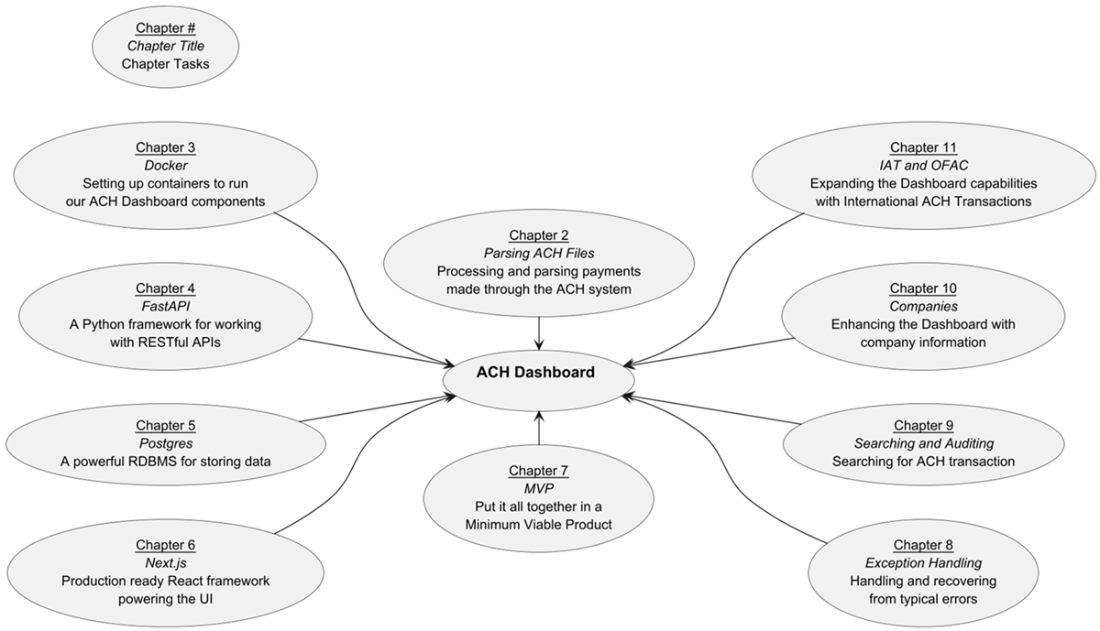

Building the ACH Dashboard

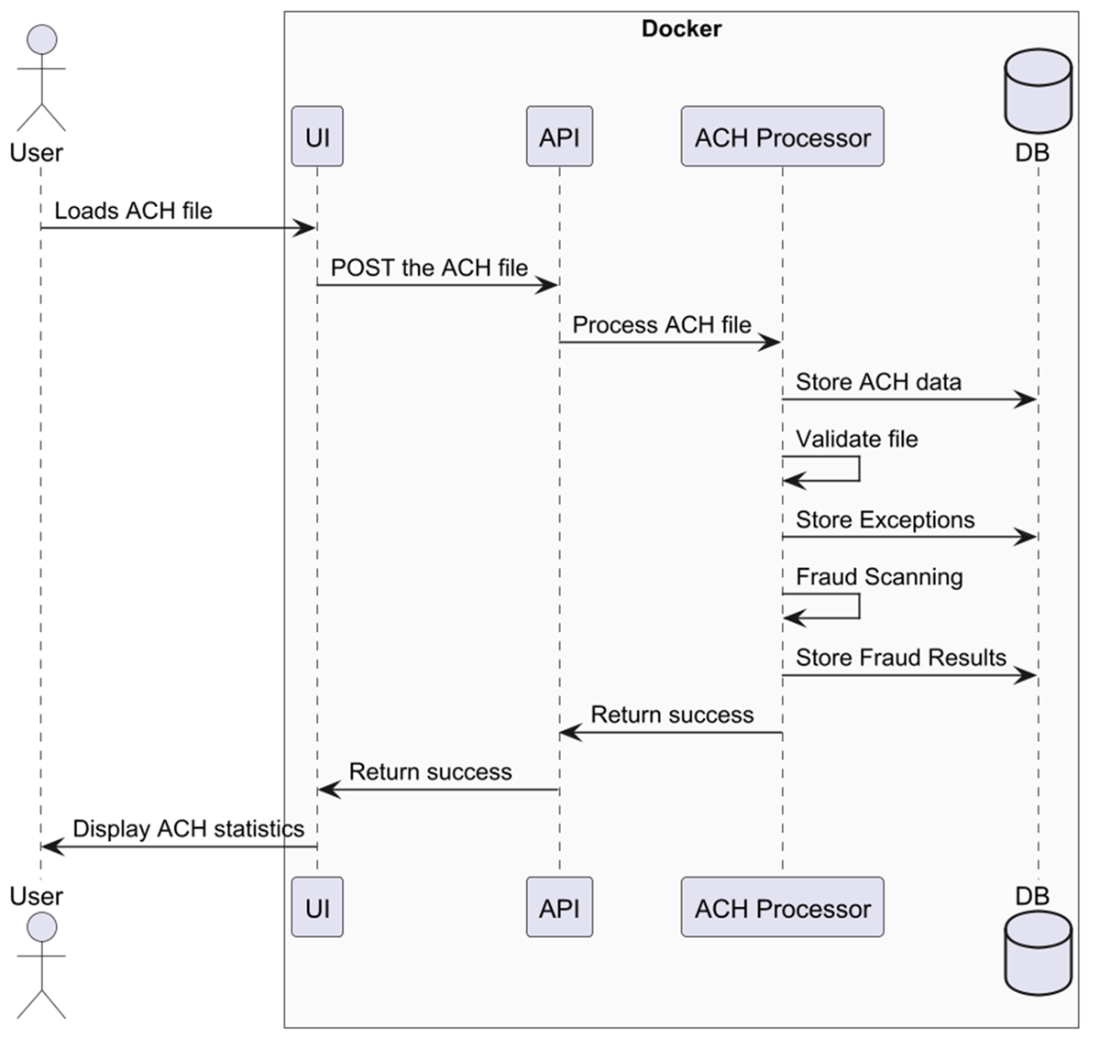

Loading a file through the ACH Dashboard

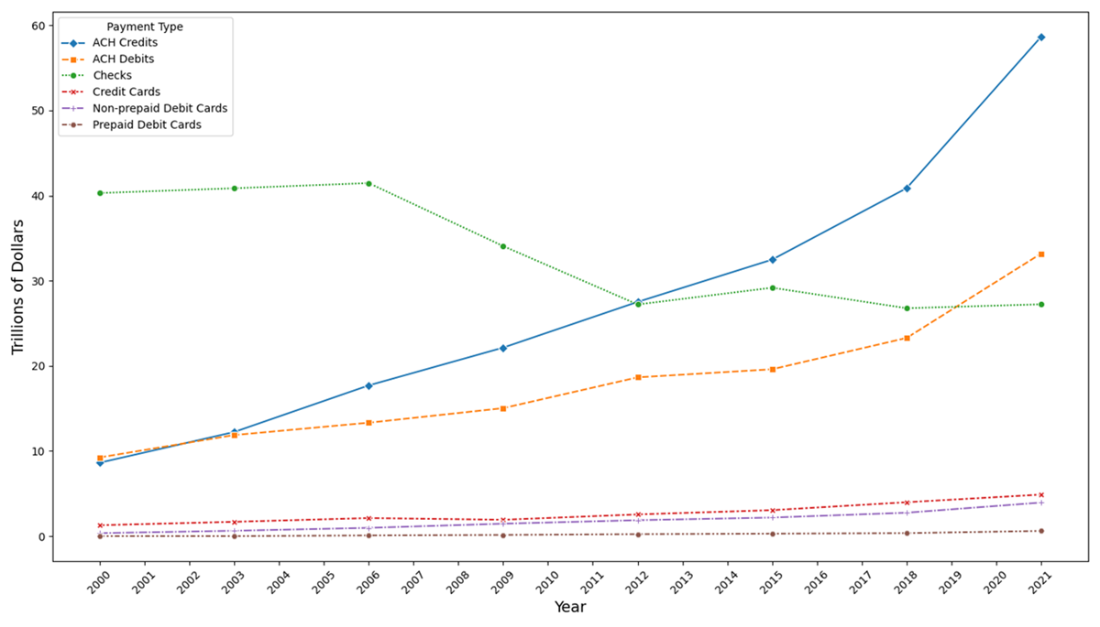

Year-over-year comparison of various payment methods

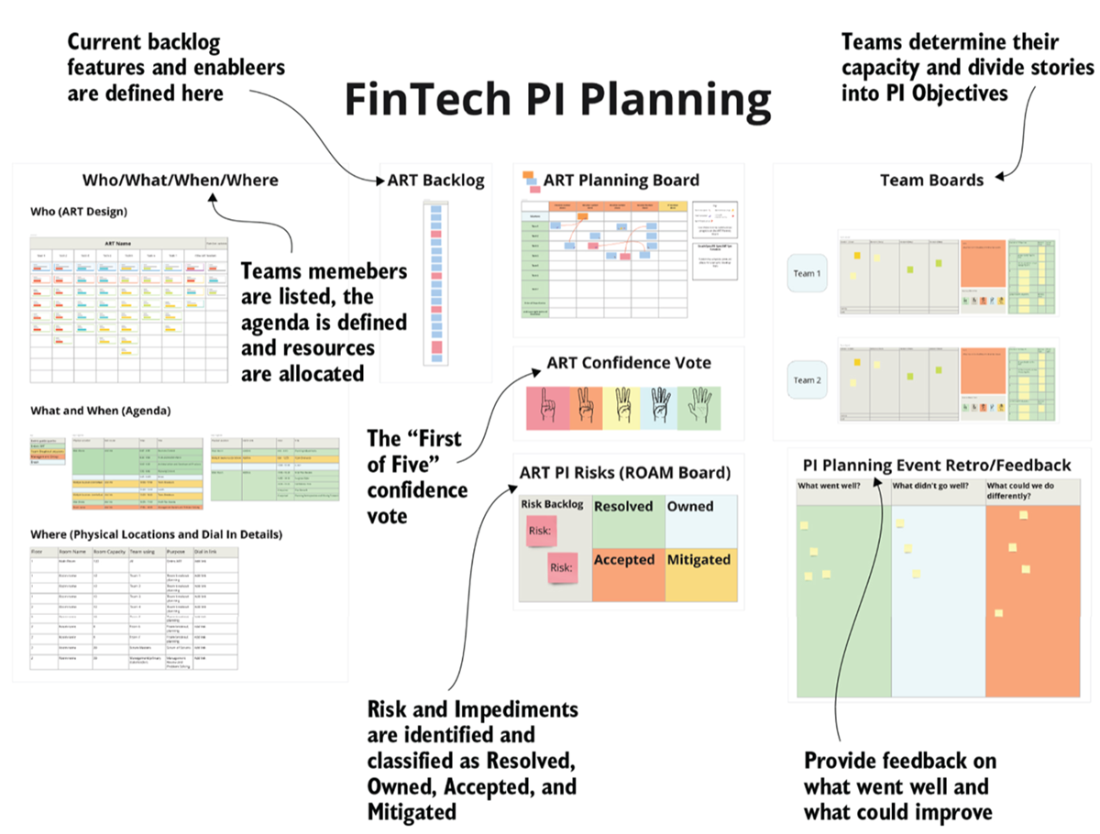

PI Planning Template in Miro

Legacy ACH Interface

Modern ACH Dashboard

ACH Dashboard Initiative

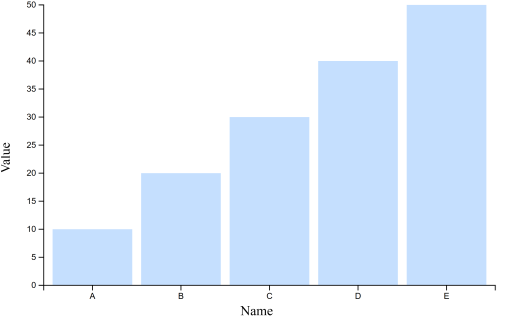

Simple Bar Chart

Bar Chart with axis and labels

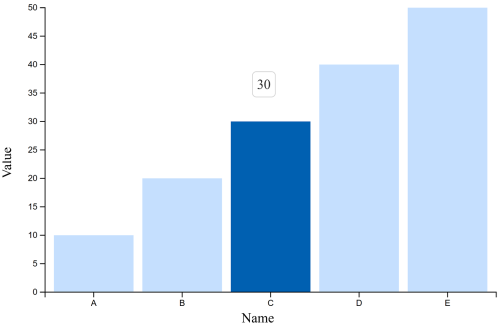

Highlighting and Hovering in our Bar Chart

Summary

- FinTech encompasses a wide range of financial technologies, historically from cash registers to modern-day applications, including crowdfunding, gig service apps, P2P payments, and cryptocurrencies.

- The book targets full stack developers in FinTech, covering end-to-end application development including UI, backend processing, and troubleshooting through real-world examples.

- We introduced the SAFe Agile framework, highlighting its widespread use in FinTech companies and the significance of Program Increment Planning in managing software development projects.

- We emphasized modernizing legacy systems using new tools and frameworks such as PostgreSQL, Next.js, Docker, and Python, and considers the impact of such changes on users and businesses.

- Generative AI is seen as an evolution of the "Rubber Duck" debugging method, providing active feedback and ideas.

- Generative AI uses Large Language Models and is integrated into various industries for increased efficiency.

- Generative AI assists in coding, debugging, syntax recall, and generating code snippets across programming languages.

- Readers should be cautious about relying on AI for up-to-date information due to potentially outdated training data.

FAQ

What is FinTech?

FinTech is the use of technology to improve how money is handled. It powers faster, more convenient, and often new ways to pay, save, invest, and move funds—from crowdfunding and gig-economy payouts to P2P apps like Venmo and traditional banking, investing, and credit products.What is the Automated Clearing House (ACH) and why is it important?

ACH is a U.S. network used to move money between bank accounts (for example, payroll direct deposits, bill payments, and account-to-account transfers). It has grown rapidly as checks decline, and enhancements like Same Day ACH have reduced settlement times from days to hours.What will I build in the ACH Dashboard project?

You’ll build a full-stack ACH Dashboard that loads ACH files, parses and stores them in a relational database, exposes data via APIs and backend processing, and presents insights in a modern UI. The project emphasizes analytics, potential fraud monitoring, and a consistent look-and-feel aligned with enterprise standards.What problems exist in the legacy ACH interface and how will modernization address them?

Key legacy limitations: no direct file uploads, minimal reporting/analytics, limited access due to server constraints, and outdated styling. The modernization initiative targets:- PostgreSQL for structured storage and BI analytics

- Next.js for a production-ready React UI with visualizations

- Docker to containerize components

- Python for new backend services

Which tools and technologies are used in this book?

The stack centers on PostgreSQL, Next.js, Docker, and Python. Common developer tools include JetBrains PyCharm/WebStorm or VS Code, JetBrains Qodana for code review, and AI assistants like ChatGPT and GitHub Copilot. You’re encouraged to substitute equivalents (e.g., MySQL, Java) if preferred.How does SAFe Agile and PI Planning fit into the project?

The team plans work using SAFe. A Program Increment (PI) spans about 8–12 weeks and includes several sprints. During PI Planning, work is shaped into epics and user stories, dependencies are identified, risks are ROAMed (Resolved, Owned, Accepted, Mitigated), and a confidence vote confirms the plan.How will Generative AI be used in the project?

Think of it as a “better rubber duck.” Generative AI helps summarize regulations, bootstrap code, troubleshoot bugs, and accelerate learning across the stack (e.g., Python, SQL, HTML/D3 for charts). It can speed up iteration if you provide clear prompts and validate outputs.What are the main risks and best practices when using Generative AI in FinTech?

Key considerations:- Privacy and security: avoid sharing NPI/PII and proprietary code; review tool policies

- Ownership/IP: understand ToS/EULA before integrating generated code

- Verification: test, review, and maintain code you adopt

- Prompt quality: be clear, concise, and provide examples

- Security guidance: see OWASP’s GenAI resources at https://genai.owasp.org/

Build Financial Software with Generative AI (From Scratch) ebook for free

Build Financial Software with Generative AI (From Scratch) ebook for free